FAQ Page 1 - ஆர்பிஐ - Reserve Bank of India

IST,

IST,

FAQs on Master Directions on Priority Sector Lending Guidelines

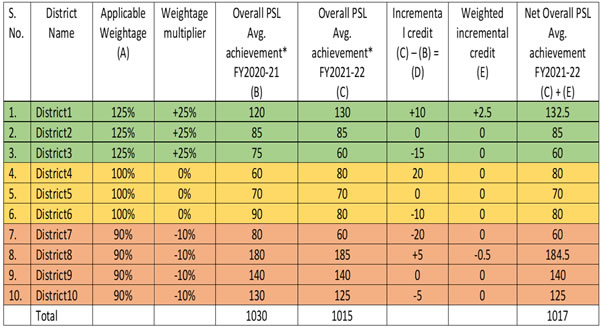

B. Adjustment for Weights in PSL Achievement

Clarification: If there is a decline in credit, the weighted incremental credit will be zero (0). The methodology as given below will be considered for all the districts for which data is reported in ADEPT. The banks are requested to get in touch with our Statistics Division (fiddstats@rbi.org.in) regarding the format for submission of returns under ADEPT, in case the same have not been submitted till date by the bank. Further, based on the methodology detailed above, banks are expected monitor their own PSL achievement during the year taking into account the prescription of differential weights for credit disbursed in identified districts, for the purpose of trading in PSLCs.

* Avg. achievement will be the average of four quarters of a year, as on reporting dates of QPSA. Similar calculations will be done for other PSL targets.

Clarification: While calculating district-wise incremental credit for assigning weights, the organic credit i.e. only the credit directly disbursed by banks and for which the actual borrower/beneficiary wise details are maintained in the books of the bank will be considered. Credit disbursed through the following inorganic routes shall not be considered for incremental weights.

-

Investments by banks in securitised assets

-

Transfer of Assets through Direct Assignment /Outright purchase

-

Inter Bank Participation Certificates (IBPCs)

-

Priority Sector Lending Certificates (PSLCs)

-

Bank loans to MFIs (NBFC-MFIs, Societies, Trusts, etc.) for on-lending

-

Bank loans to NBFCs for on-lending

-

Bank loans to HFCs for on-lending

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: Non-filing of the return on or before due date (July 15 of every year) will be treated as a violation of FEMA and penalty clause may be invoked for violation of FEMA. For further details on penalty clause, please see the below links:

Core Investment Companies

Core Investment Companies (CICs)

Ans: No, Existing CICs which have been exempted from registration in the past and have an asset size of less than Rs 100 crore are exempted from registration as stated in Notification No. DNBS.(PD) 220/CGM(US)-2011 dated January 5, 2011. As such they are not required to submit any auditor’s certificate that they comply with the requirements of the Notification.

Remittances (Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA))

Rupee Drawing Arrangement (RDA)

Framework for Compromise Settlements and Technical Write-offs

A. COMPROMISE SETTLEMENT IN WILFUL DEFAULT AND FRAUD CASES

No. The cooling period has been introduced as a general prescription for normal cases of compromise settlements, without prejudice to the penal measures applicable in respect of borrowers classified as fraud or wilful defaulter as per the Master Directions on Frauds dated July 1, 2016 and the Master Circular on Wilful Defaulters dated July 1, 2015, respectively, as mentioned at (2) above.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Details of survey launch

Ans.: Biennial.

Foreign Investment in India

FAQs on Non-Banking Financial Companies

Registration

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: null