Speeches - ஆர்பிஐ - Reserve Bank of India

IST,

IST,

Speeches

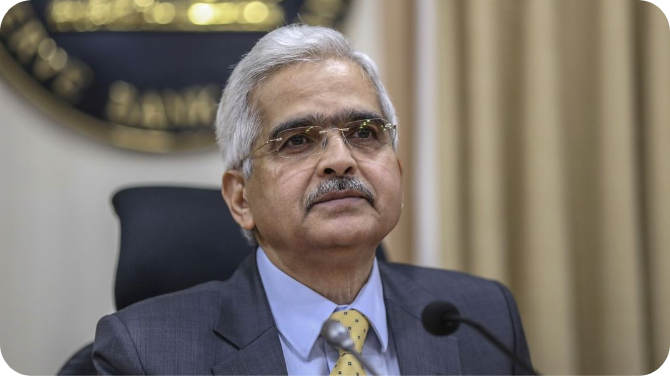

When I travel from my residence in Vile Parle (W) to the Reserve Bank of India Central Office in Fort, I pass each way Kenilworth – the birth place of late Homi Jehangir Bhabha. It is a good way to start and end the day, being reminded not just of his immense intellect but also of his deep sense of service to India. I am thus grateful to Professor Dipan Ghosh, who was the Dean of Students during my time at IIT Bombay, for inviting me to speak today in the Homi Bhabha

When I travel from my residence in Vile Parle (W) to the Reserve Bank of India Central Office in Fort, I pass each way Kenilworth – the birth place of late Homi Jehangir Bhabha. It is a good way to start and end the day, being reminded not just of his immense intellect but also of his deep sense of service to India. I am thus grateful to Professor Dipan Ghosh, who was the Dean of Students during my time at IIT Bombay, for inviting me to speak today in the Homi Bhabha

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: null

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்:

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: