Financial Literacy - CAB - Reserve Bank of India

IST,

IST,

Financial Inclusion and Financial Literacy Learning Centre (FIFLC)

Overview

Financial inclusion plays an important role in the financial well-being of people, poverty alleviation, achievement of sustainable development goals, and economic growth. Financial inclusion is also an enabler in eradicating poverty. It reduces inequality in society, helps in reducing hunger, and achieve food security. Financial literacy and education lends sustainability to the outcomes of financial inclusion. Accordingly, it has been an integral part of the financial inclusion initiatives in India.

Vision of the centre

The Centre hosts a complete range of financial literacy content to provide three-dimensional inputs on Knowledge, Skills and Attitude. The content provides important information on various forms of money and transactions, access to financial services, digital payment products, credit and credit discipline, the importance of livelihood, consumer education and protection, and theme-based messages on Financial Literacy.

The Centre hosts a complete range of financial literacy content to provide three-dimensional inputs on Knowledge, Skills and Attitude. The content provides important information on various forms of money and transactions, access to financial services, digital payment products, credit and credit discipline, the importance of livelihood, consumer education and protection, and theme-based messages on Financial Literacy.

The Centre has a tree that explains the basic concepts of financial literacy.

The Centre has two information kiosks. One of the kiosks hosts e-learning on financial literacy and another kiosk has quizzes on financial literacy, MSME customer education, financial inclusion and consumer protection. that explains the basic concepts of financial literacy.

There is also a snake and ladder game that teaches how to differentiate between a good and a bad financial decision.

The Centre has an interactive display to disseminate information on functions and working of RBI.

The benefits of savings are also displayed.

The Centre also provides details about various elements of planning & managing finances.

The Centre provides information about a bank and how to access financial services.

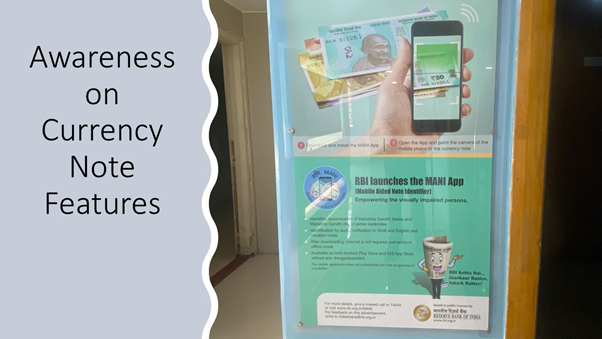

The Centre provides information about the currency note features and the MANI App.

Hon’ble Prime Minister launched the Integrated Ombudsman Scheme and RBI Retail Direct Scheme on November 12, 2021. The Centre is creating awareness about the two schemes.

Livelihood and Micro Finance play an important role in Financial Inclusion. The Centre explains the concepts of Self-Help Groups, Joint Liability Group, Micro Finance and convergence with livelihood.

Livelihood and Micro Finance play an important role in Financial Inclusion. The Centre explains the concepts of Self-Help Groups, Joint Liability Group, Micro Finance and convergence with livelihood.

With a view to promote digital financial services, the centre spreads awareness about the digital products and services as well various guidelines on consumer protection and good practices to be followed.